Considerable Market Uncertainties for EVs in North America

We dive here into market considerations. What will the market for EVs look like in the US and Canada in the next years. Will the market demand exist for a massive EV industrial development in Ontario?

The article is also available as a podcast on Spotify, Apple, etc.

The Canadian automotive sector, which is mostly located in Ontario, has always been highly dependent on the existence of a strong market, and of course on market access, in the US. Will such high reliance on the US market be possible with made-in-Canada electric vehicles? And will the actual market demand for EVs be as high as anticipated to justify the recently announced massive investments and subsidies?

We will look at these considerations in this analysis, which stresses the critical role of national-level politics, both in the US and in Canada, for the future of EVs in North America. Other important factors, such as the competition from China and disparate electricity prices, are also looked at. We then show that the report by Canada’s Parliamentary Budget Officer about the billions of dollars of subsidies for battery plants in Ontario, while highly critical of the governmental decisions, actually underestimates the risks of those investments.

The Critical Role of the US Market for Made-in-Canada EVs

The Canadian automotive industry has always been largely reliant on exports to the US. Accordingly, a strong US market is critical for EVs to become “Canada’s New Economic Engine.”

“Canada’s New Economic Engine” is actually the title of the September 2022 report by two think tanks/NGOs — Trillium Network and Clean Energy Canada — on which the Canadian government largely relied for its EV industrial development plans.

The key assumptions / targets, found in this report, and adopted by the Canadian federal government for its EV industrial development strategy, are:

Canada meets its zero-emission light-duty vehicle sales target of 60%, with the U.S. reaching 33%, by 2030.

Zero-emission medium- and heavy-duty sales reach 35% in Canada and 16% in the U.S. by 2030.

1.05 million EVs are to be assembled annually in Canada by 2030.

This EV expansion is not only massive but is also expected to occur within a time frame of just 7 years.

In both countries, EVs are presently at less than 10% market share for new vehicles. In Q1 of 2023, the market share of EVs (excluding hybrids) was just 7% in the US. In Canada, in Q2 of 2023, “zero emission” vehicles, which includes plugin hybrids, had a 8.6% market share, which is a far cry from the pledged 60% by 2030.

As for the 1 million electric vehicles to be assembled in Canada by 2030, the starting point is … zero. There are no light electric vehicles assembled presently in the country, and no assembly plant will be operational any time soon.

Presently, about 90% of the conventional automotive production in Canada is exported. Assuming similar international trade patterns for EVs, Canada would be expected to export to the US some 900,000 EVs, or for US$26.4 billion worth of electric cars annually, by 2030.

It’s not at all as if made-in-Canada EVs would mostly be retailed on the Canadian market. Canadian consumers are used to choose among many brands and models of vehicles. Imports, from the US, South Korea, China and elsewhere, can be expected to constitute the bulk of the EVs to be sold in Canada. In turn, Canada will have no choice but to export most of its EV production to the US.

With a rapidly growing EV industry in the US, with many models available for importation by the US from countries such as South Korea and China, and with no EV assembly plants to be opened in Canada any time soon, the task ahead for a Canada-based EV industry is formidable.

Which Companies Will Assemble EVs in Canada?

Ford is the first major manufacturer to have announced light EV manufacturing in Canada, in Oakville, Ontario.

Ford intends “to transform its Oakville complex in the second quarter of 2024 to prepare for production of next-generation electric vehicles beginning in 2025.”

The federal government and Ontario have pledged to spend up to $500 million to make the Ford plant in Oakville capable to build electric vehicles.

Ford presently produces 2 battery EVs: the F-150 Lightning (MSRP Range: US$49,995 - $91,995) at the Rouge Electric Vehicle Center in Dearborn and the Mustang Mach-E(MSRP Range: US$42,995 - $59,995) at its Cuautitlan facility on Mexico.

In 2023, “in the first quarter, which means that the carmaker lost $58,333 for each clean car sold during this period.”

There has not been any announcement about which specific Ford models - there should be 5 of them - will be manufactured in Ontario.

As far as vehicle assembly, the other manufacturers have not made any such announcements to set up assembly plants.

The announced plants, by Stellantis and VW, with massive subsidies, focus on batteries.

No Tesla Giga-Factory in Sight

When it comes to EVs in North America, one manufacturer, Tesla, is way ahead in terms of vehicle and battery manufacturing.

Tesla has a relatively limited presence in Ontario, in Markham and in Richmond Hill, for building manufacturing equipment to be used in giga factories.

There are no signs, however, that the corporation is to build any major manufacturing facility North of the 49th Parallel.

Currently, in terms of giga-factories, Tesla is present in the US, China and Germany. Tesla has announced further investments in the US, in Mexico and in China, but not in Canada.

If Ontario, or Canada more generally, had been such an obvious choice for EVs, Tesla would probably already have, or at least would have concrete plans for, a giga-factory in Ontario or elsewhere in the country.

But, there are no Tesla giga-factory in sight. Is Elon Musk, who studied at Queens in Kingston, Ontario, wrong, or wise, about this?

EV Mandates & Incentives to be Dropped in the US by 2025?

The future of EVs in the US will largely depend on the outcome of next year’s presidential election. If the Democrats are re-elected, one can expect further support to EVs.

In case the Republicans take over, the EV mandates are most likely going to be cancelled.

The two leading Republican candidates, Tump and DeSantis, have already announced that they will leave people the choice of the vehicle they want to drive.

Donald Trump is now poking fun at any opportunity about EVs and the Biden mandates, which he has pledged to get rid off immediately, if he gets elected.

More and more, with the Trump voters, EVs are becoming a laughing stock, not a means of transportation!

Ron DeSantis has also stated he would reverse the Biden EV mandates:

“We're going to rip out all the Biden mandates, all this stuff that they're doing to try to promote EVs.”

Like with Trump, DeSantis’ message is clear. See also this article.

According to RealClearPolitics, it’s presently about 50-50% chance the Democrats or the Republicans will win next year’s presidential election.

If the mandates and other incentives are dropped to promote EVs in the US, the demand for EVs is expected to drop considerably, to maybe around 5% of US new car market, or even less.

Remember, polls, such as this one by JustTheNews, indicate that real consumer demand for EVs is very low, at around 1%, and that what is seen, in terms of purchases, results from various regulations, subsidies, tax credits.

In case of a Republican win, the market potential for Canadian EV exports to the US will be dramatically reduced.

Election Day will be November 5 2024. But even by that time, if the election is contested, the winner may not be known.

Any investment in EVs in North America is now immersed into the considerable uncertainty associated with the US presidential election.

The billions of dollars thrown by Canada and Ontario to develop an EV industry may be wasted, simply because of the uncertainty of the future existence of a substantially sized EV market in the US.

China is a Formidable Market Competitor

Currently, according to driving.ca, the best selling EVs in Canada are: Tesla Model 3, Chevrolet Bolt, Hyundai Kona; Volkswagen ID.4 and Hyundai Ioniq 5.

The Tesla Model 3 and Y retailed in Canada increasingly originate from China. The Volkswagen ID.4 is already produced both in Germany and in the US. Hyundai manufactures its models in Asia (South Korea) and has announced a giga-factory in Georgia, USA. The Chevrolet Bolt is built in Orion, Michigan, USA.

So presently, China is mostly present through Tesla in Canada, but things can be expected to change, especially as BYD already produces appealing models, that are not yet imported to and distributed in Canada.

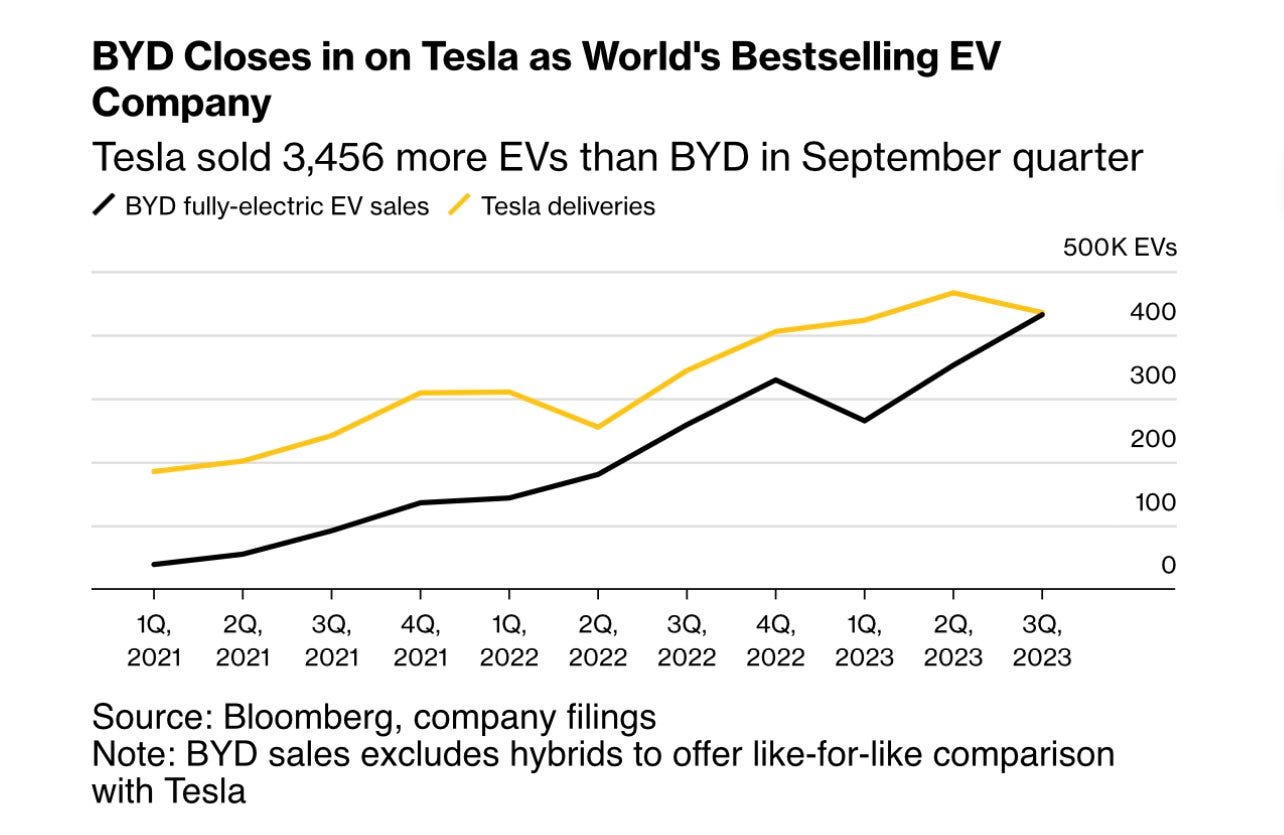

Chinese automaker BYD, which offers both EVs and Plug-In Hybrids, is leading the charge (funny expression?) when it comes to the dominance of the global EV market.

A full line up of EVs is already produced by BYD.

In Canada, BYD is manufacturing buses, but does not sell yet vehicles, nor in the US. In the Province of Québec, some BYD EVs were imported and are used as taxis.

In the UK, BYD announced it would start selling cars in 2023, offering 3 models: ATTO3, Dolphin and Seal.

The Dolphin, which is a compact SUV, is seen by the Autocar UK media, as bringing “long range and impressive practicality to small EV class at very keen price.”

Pricing in the UK for the Dolphin starts from £26,195 i.e. US32,000.

This review presents the Dolphin as “an electric hatchback sized roughly between the Vauxhall Corsa Electric and the Volkswagen ID 3.”

As a comparison, for the VW ID 3, “Prices start from £37,115 in the UK, rising to £42,870 for the range-topping Pro S.”

And for the Vauxhall Corsa-e Elite Premium is priced at £31,695.

As a reference point, the Tesla Model 3 is priced from £41,990 in the UK.

See the Dolphin specs and the pricing of the different vehicles here.

Just from this example, one sees that it will be hard to compete with EVs such as the BYD Dolphin.

Currently, the EVs popular in Canada are relatively small models. Chinese models such as the Dolphin may therefore seize a significant share of the domestic EV market, possibly even hurting market leader Tesla.

Can Canada rapidly develop an EV industry and produce models that are attractive to consumers, at such “very keen prices”? It looks very challenging indeed, even with billions of dollars thrown at the EV industry.

In addition to regulations regarding safety, which should not be problematic to overcome, there is an import duty on vehicles from China, of apparently 6.1%, but this should not be a big issue for the competitiveness of such imported vehicles.

The demand for made-in-Canada batteries will logically be negatively impacted if Chinese EVs capture a substantial market share.

There are important international trade and even geopolitical considerations associated with an increasing role of China in the international automotive sector, but we will not look at them in the context of this present analysis.

What about the Future Market for EVs in Canada?

In Canada, “zero emission vehicles” are curiously defined, as battery-electric and plug-in hybrid electric vehicles do qualify, so are (not yet commercially available) hydrogen fuel cell vehicles.

Don’t laugh … that’s what the regulation is. Even a plug-in hybrid, having an exhaust and running partly on gas, is “zero emission.”

By 2030, in just 7 years, 60% of all vehicle sales must be “zero emission” and there will be penalties imposed on manufacturers and importers in case of no compliance. By the 2035, 100% is the target.

The federal EV policies by the Liberal government follow closely those adopted in California, and by the US Environmental Protection Agency.

These are precisely the types of regulations that will most likely be axed, at the federal level, in case of a Republican presidential win next year in the US.

Interestingly, the already mentioned survey about electric vehicles in Canada shows that for larger, heavier models, Canadian consumers (logically) tend to opt for hybrid vehicles when seeking a “zero emission” option, because they have more range and convenience.

So, the “zero emissions” plugin hybrids may have a bright future in Canada, despite their typically high price, their typically low energy efficiency, and … the fact that they actually generate emissions! :)

Electricity Prices are Also a Factor

In some Canadian provinces, a big appeal of EVs is the low price of electricity. But there is a huge variability in electricity prices in the country.

The low price champion is Québec, at 7.8 cents per kWh, thanks to massive investments in hydro power decades ago.

In Québec, electricity from hydro power is widely used, including to heat homes - something that is not done in high electricity price jurisdictions.

Ontario, which has some hydro and nuclear, is at 14.1 cents per kWh.

Provinces such as Alberta and Saskatchewan have much higher prices, at respectively 25.8 and 19.9 cent per kWh.

Such higher electricity prices considerably reduce the appeal of EV ownership.

Note that electricity prices may increase substantially in provinces such as Québec and Ontario, because of the need to increase electricity generation, to meet the increased demand not only by electric vehicles but also from population growth (lots of immigration recently) and new power needs.

New hydro dams take ages to plan, agree upon with indigenous people, First Nations, to build and make operational. It’s mainly in Québec that the potential for such large scale hydro dams still exist, but is unlikely to be exploited.

See this video of the latest major dam to have been built in Northern Québec: La Romaine.

Nuclear is also slow and not well accepted by the population, especially in Québec where a nuclear plant was prematurely closed. So higher prices may well be on the horizon. In Ontario, it appears that further nuclear development is to be anticipated. This is usually costly and takes time, lots of time.

With a transition to EVs, governments will also seek to offset their losses from reduced tax revenues from the sale of gasoline, and seek to charge taxes on electricity or mileage.

Yes, unlike electricity, gasoline and diesel are heavily taxed. Electricity price increases are already happening in countries such as France, and will likely happen in Canada, sooner or later.

So the cost for recharging EVs is likely to go up and up, again, reducing the appeal of the EVs, despite the incentives/rebates for the “zero-emission vehicles.”

Note that the premier (prime minister) of Alberta was seen testing an hydrogen powered car. There is little appetite in Alberta, which is a fossil fuels powerhouse, for either carbon taxes or EV mandates.

What about Canadian EV Politics?

What about EV politics in Canada? As we have already seen with Ontario, it’s “complicated” with a “Progressive Conservative” provincial government actually following the policies of the federal Liberals.

Now, what about the main opposition party at the federal level, The Conservative party of Canada, led by MP Pierre Poilièvre?

Mr Poilièvre has shown early interest in the question of EVs, as he had this very relevant conversation with world-class expert Mark Mills on the topic in July 2021.

Mr Poilièvre is yet to outline a clear, up to date, position about EVs and their development in Canada. Yet it is known that he wants the (Liberal) carbon tax to be axed, and that he is highly skeptical about the giga subsidies offered for battery giga factories.

It was actually Mr Poilièvre who asked the Parliamentary Budget Officer (PBO) to analyze the merits of the battery giga-factories.

So the likely position of the Conservatives is to repeal at least some of the Liberal pro-EV regulations, mandates and targets in Canada, and allow for the continuation of the sale of new ICE vehicles beyond 2035.

The Canadian Conservative discourse may not become as flamboyant as that of Trump or DeSantis, but the result may be equivalent: a considerable reduction in the (mandated) market demand for EVs.

It’s not known when the next federal election will take place in Canada. It must take place on or before October 20, 2025. But the federal general election could also take place well before, as the Liberals are now in their third term and seem to suffer from what is called in French the “usure du pouvoir,” i.e. the test of time.

Current polls suggest the Conservatives will win over the Liberals, but those polls don’t mean that much as we may not be near the next election, and like in the US, a popular majority in Canada doesn’t necessarily imply an election victory.

For the upcoming election, Ontario will play a critical role, in the overall results, especially as the Conservatives remain relatively weak in the Province of Québec. So EVs, and the Ontario giga battery subsidies, may become important electoral issues for the next federal election.

What does all of this mean in terms of market demand? Like in the US, the future of the Canadian market demand for EVs is uncertain, as it is artificially created by subsidies, mandates and regulations, rather than by consumer demand.

Now, if you combine the US and Canadian uncertainties associated with the upcoming elections, and give each side — Democrats & Republicans in the US, Liberals & Conservatives in Canada — a 50% chance of winning, you end up with only a 25% chance that the EV mandates are to be maintained in both countries.

So there is only about a 25% chance that the fundamental assumptions by the Canadian government, embedded in the “New Economic Engine” report, to justify the battery giga-factories, will be respected.

Yep: a 25% chance only.

Let that sink in! :)

The PBO Report, Highly Critical of the Battery Giga-Factory Subsidies, is Actually Optimistic!

Just a month ago, on September 12, the Office of the Parliamentary Budget Officer released a report titled “Break-even Analysis of Production Subsidies for Stellantis-LGES and Volkswagen.”

The report sheds light on some of the considerable issues associated with the giga-subsidies agreed upon by the federal government to lure foreign investors to develop an EV industry and create (extremely expensive) jobs in Ontario.

Since then, a third such battery plant announcement has been made in the Province of Québec, again with billions of subsidies by the federal and provincial governments.

Taxpayers, already severely harmed by severe inflation and other post-pandemic issues, are being solicited big time in Canada. The future of cars is electric, eh!

The PBO report “provides a break-even analysis of the support for Stellantis-LG Energy Solutions and Volkswagen to estimate the period over which government revenues generated from their EV battery manufacturing plants will be equal to the total amount of production subsidies announced by the governments of Canada and Ontario.”

The report key finding is:

“PBO estimates that federal and provincial government revenues generated from the Stellantis-LGES and Volkswagen EV battery manufacturing plants over the period of 2024 to 2043 will be equal to the total amount of production subsidies ($28.2 billion)—a break-even timeline of twenty years.”

Yes, you read it well: a break-even timeline of twenty years!!

Not the 5 years claimed by the Canadian government!!

Parliamentary Budget Officer Yves Giroux made further comments, in media interviews, such as this one.

He stressed the uncertainty of future battery technology, which may make lots of these investments obsolete.

He also stressed that the new factories may not create employment but simply hire a workforce laid off in plants expected to close because of the transition to EVs.

And he mentioned that the actual industrial linkages with the battery plants, such as the opening of new mines, were not at all guaranteed, so that the only thing sure with these multi-billion subsidies is that there would be facilities to manufacture batteries (with the present technology, which may be obsolete by then).

The Canadian government immediately brushed aside the criticisms. Through its Minister of Innovation, Science and Industry, it stated:

“The Parliamentary Budget Officer’s analysis released today demonstrates that the Stellantis-LGES and Volkswagen investments are good deals for Canadians, the auto sector and the entire supply chain.” … “these investments will generate economic benefits far greater than our government’s contribution.” “We will continue to work tirelessly to attract investments, create good jobs for Canadians, and lead in the green economy of the future.”

The Canadian federal government in fact doubled down shortly after on these multi-billion battery investments with the announcement of a NorthVolt battery giga-factory in Québec.

While the PBO report 20 year break-even point is obviously much less optimistic than the 5 year break even point from official governmental report, both reports fail to take into account the massive uncertainty, outlined above, with the EV market in North America.

The PBO analysts explain in their report that the federal government relied on modelling done by the Trillium Network for Advanced Manufacturing (Trillium Network) and Clean Energy Canada in their 2022 report, “Canada’s New Economic Engine.”

The “New Economic Engine” report identifies four scenarios, and the government, through its Innovation, Science and Economic Development (ISED) department, relied on Scenario #3 for its own analysis, and this is the scenario that PBO looked at in their analysis.

The key assumptions for Scenario #3 include:

Canada meets its zero-emission light-duty vehicle sales target of 60%, with the U.S. reaching 33%.

Zero-emission medium- and heavy-duty sales reach 35% in Canada and 16% in the U.S.

There are also (optimistic) assumptions related to the development of vehicle assembling, mining, cathode production and recycling. “The attraction of one more major battery cell facility” is however on its way to be achieved, with the NorthVolt Québec announcement, at the cost, again, of billions of dollars of taxpayers money.

As we have seen, the EV targets both in the US and Canada can only be achieved through mandates and massive subsidies, and those are unlikely to be continued in case a Republican wins the White House next year or if a Conservative becomes Prime Minister of Canada at the next election.

Without mandates and subsidies, the demand for EVs will be much much lower, say, for the sake of throwing a guessed number, like 90% lower, and thereby destroying any (already extremely weak) rationale for these battery giga-factory subsidies, not only in Ontario but also in Québec.

Given the current reliance of the Canadian / Ontarian automotive industry on the US market, even in case of a Liberal victory in Canada at the next federal election, there is a 50% chance that the whole EV industry development in Canada will fall apart.

Indeed, the market demand for EVs in the US will, in that case, not grow significantly, and the 33% market share target for EVs in the US will never be met. It won’t even be close.

Without EV mandates, existing or planned manufacturing facilities in the US, by Tesla, Chevrolet, Hyundai and others, and of course imports from China, will be able to meet market demand, without the need for any made-in-Canada EVs or even batteries.

There is clearly a huge difference between the rosy Scenario #3 of the “New Economic Engine” report on which the Canadian government relied to develop its EV industrial strategy, and the reality of at least a 50% chance that the whole thing will pretty rapidly fall apart, with the upcoming national/federal elections in the US and Canada.

With the political uncertainty both in the US and Canada, there are serious chances that these billions of subsidies will actually build sorts of giga white elephants, rather than real productive factories.

Remember, even with the mandates in place, the PBO report found that it would take 20 years for the thrown billions of dollars to be recouped by the government.

If one factors in the considerable market uncertainty associated with the upcoming election cycles, these investments appear much worse, much more risky, than what the Parliamentary Budget Officer report maintains.

Again, and I am repeating myself, I know: Let that sink in! :)

This completes part 2 of our analysis about EV development in Ontario and Canada.

Please share, subscribe and like (if you liked it!).

Comments and suggestions are welcome.